When it comes to finding the right car insurance in Worcester, Massachusetts, making an informed decision is crucial.

Understanding the costs, coverage options, and the best insurance companies in the area can help drivers navigate the complex world of insurance with confidence.

In Worcester, car insurance averages at $134 per month for full-coverage and $92 per month for liability-only plans, providing a baseline for comparison.

Among the top car insurance companies in Worcester is GEICO, known for its superior financial strength and high customer satisfaction ratings.

Other reputable insurers in the area include Allstate, Amica, and Travelers, offering a range of coverage options to meet diverse needs.

With the legal requirement of car insurance in Massachusetts, drivers must choose wisely to ensure both legal compliance and adequate protection on the road.

Top 10 Car Insurance Providers in Worcester, MA

Here are ten car insurance providers in Worcester, MA:

1. Amica

Amica Mutual Insurance Company, established in 1907, holds the distinction of being the oldest mutual insurer in the United States.

Amica’s longevity is matched by its commitment to customer satisfaction, which is deeply ingrained in its corporate culture.

Serving Worcester, MA, Amica offers a variety of auto insurance policies tailored to meet the diverse needs of local drivers.

They are known for their competitive rates and emphasis on personalized service, leveraging a direct writer approach that ensures direct communication between customers and the company.

Amica’s claims process is streamlined, and their customer service is highly rated, making them a preferred choice for those seeking reliable coverage with a personal touch.

2. Geico

Geico is celebrated for its strong financial stability and customer-centric approach to auto insurance in Worcester, MA.

With a reputation built on efficiency and savings, Geico offers a range of discounts that appeal to cost-conscious drivers, including multi-policy discounts, safe driver discounts, and discounts for vehicle safety features.

Geico’s online platform simplifies the quote process and policy management, allowing customers to handle their insurance needs conveniently.

Despite its size, Geico maintains a local presence through agents who provide personalized assistance to policyholders in Worcester, ensuring they receive the support they need.

3. Arbella

Arbella Insurance has established itself as a trusted provider of auto insurance in Worcester, MA, known for its commitment to customer service and community involvement.

Arbella offers competitive rates and a variety of coverage options designed to meet the specific needs of local drivers. They prioritize customer satisfaction, providing responsive service and clear communication throughout the insurance process.

Arbella’s dedication to the Worcester community extends beyond insurance, as they actively participate in local events and support charitable initiatives, reinforcing their reputation as a reliable and caring insurance provider.

4. Progressive

Progressive Insurance has carved out a niche in Worcester, MA, with its innovative approach to auto insurance. Progressive is known for its user-friendly tools and services that simplify the insurance experience, such as the Name Your Price® tool and Snapshot® program.

These offerings allow drivers to customize their coverage and potentially lower their premiums based on their driving habits. Progressive’s commitment to transparency and customer empowerment resonates with Worcester residents seeking flexible coverage options and competitive rates.

Their claims process is efficient, and their customer service is accessible, making them a popular choice among tech-savvy drivers.

5. Allstate

Allstate Insurance Company is a prominent name in the insurance industry, recognized for its comprehensive coverage options and strong customer service ethos.

In Worcester, MA, Allstate offers a wide range of auto insurance products tailored to protect drivers and their vehicles.

They emphasize personalized service through a network of local agents who are dedicated to helping customers understand their coverage options and make informed decisions.

Allstate’s commitment to innovation is reflected in their suite of digital tools, which provide convenient access to policy information and claims support, enhancing the overall customer experience.

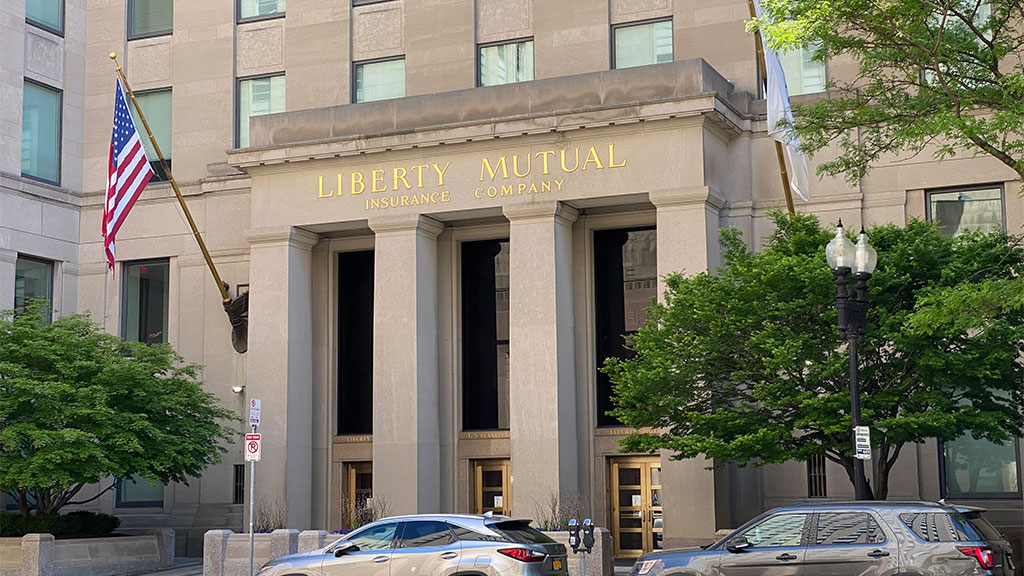

6. Liberty Mutual

Liberty Mutual has established a solid presence in Worcester, MA, offering a variety of auto insurance products designed to meet the needs of local drivers.

Liberty Mutual combines personalized service with competitive rates, making them a preferred choice among residents seeking reliable coverage.

Their claims process is straightforward, and their customer support is responsive, ensuring that policyholders receive prompt assistance when needed.

Liberty Mutual’s commitment to customer satisfaction is evident in their efforts to continuously improve their services and offer innovative solutions that address the evolving needs of Worcester drivers.

7. State Farm

State Farm is renowned for its extensive network of agents and a wide range of insurance products, including auto insurance in Worcester, MA.

They offer personalized service and a variety of discounts, such as multi-policy discounts and safe driver discounts, to help customers save on their premiums.

State Farm’s local agents are knowledgeable about the Worcester community and provide personalized advice to ensure that policyholders have the coverage they need.

Their commitment to customer relationships is underscored by their robust mobile app and online tools, which facilitate easy policy management and claims processing.

8. Nationwide

Nationwide Insurance provides dependable coverage options and competitive rates for drivers in Worcester, MA.

They prioritize customer service and offer a range of discounts, including multi-policy discounts and accident forgiveness, to help policyholders save money.

Nationwide’s strong financial stability and ethical business practices make them a trusted choice for auto insurance in the local community.

They offer comprehensive coverage options that can be tailored to meet individual needs, with additional features like roadside assistance and rental car reimbursement available to enhance the overall coverage experience.

9. Travelers

Travelers Insurance offers customizable auto insurance policies designed to meet the unique needs of drivers in Worcester, MA.

Known for their financial strength and excellent customer service, Travelers provides peace of mind to policyholders by offering comprehensive coverage options that include liability, collision, and comprehensive insurance.

They also offer additional features such as roadside assistance and rental car reimbursement, ensuring that drivers are well-protected on the road.

Travelers’ commitment to customer satisfaction is evident in their responsive claims handling and proactive communication with policyholders.

10. USAA

USAA specializes in serving military members and their families with auto insurance policies tailored to their unique needs.

In Worcester, MA, USAA offers competitive rates and top-notch customer service, making them a preferred choice for military personnel.

USAA’s commitment to serving those who serve includes flexible payment options, personalized advice from knowledgeable agents, and comprehensive coverage options designed to protect military members and their families on the road.

Their digital tools and mobile app provide convenient access to policy information and claims support, ensuring that military members can manage their insurance needs efficiently.

How to Choose the Right Car Insurance in Worcester

When selecting car insurance in Worcester, individuals should assess their insurance needs carefully. Consider factors such as the level of coverage required based on driving habits and budget constraints.

Assessing Your Insurance Needs

To choose the right car insurance in Worcester, one must first assess their insurance needs. Evaluate the type of coverage required based on factors like the age and condition of the vehicle, driving habits, and the amount one can afford to pay as premiums.

Understanding these needs will help in selecting appropriate coverage that provides adequate protection without unnecessary costs.

Researching the reputation of insurance companies is crucial. Look for customer reviews and ratings to gauge the quality of service and claims process.

Comparing quotes from the top insurance companies in Worcester, Massachusetts, such as AAA, Arbella, and Safety Insurance, can help in finding the best coverage at competitive rates.

Tips for Comparing Insurance Quotes

Comparing insurance quotes can help you find the best coverage at the most competitive rates. Here are some tips to effectively compare insurance quotes:

Understand Your Coverage Needs

Before comparing quotes, assess your coverage needs. Consider factors like your vehicle type, its value, your driving habits, and any specific coverage requirements mandated by your state or lender. Understanding these factors will help you determine the types and levels of coverage you need.

Compare Apples to Apples

When reviewing quotes from different insurers, ensure you are comparing similar coverage levels and deductibles.

A policy with a lower premium might have higher deductibles or less coverage, which could impact your financial risk in case of a claim. Ensure you’re comparing similar policies to get an accurate comparison.

Check Financial Strength and Reputation

Evaluate the financial strength and reputation of each insurance company. Look up their ratings from independent agencies like A.M. Best, Moody’s, or Standard & Poor’s.

A financially stable insurer is more likely to meet its financial obligations and pay claims promptly, providing you with peace of mind.

Look Beyond Price

While cost is important, it’s not the only factor to consider. Assess the insurer’s customer service reputation, claims handling process, and availability of discounts or special programs.

A company with excellent customer service and a streamlined claims process may provide better overall value than one with a slightly lower premium.

Research Discounts

Inquire about available discounts that could lower your premium. Common discounts include multi-policy discounts (for bundling auto and home insurance), safe driver discounts, good student discounts, and discounts for vehicle safety features. Ask each insurer about the discounts they offer and how you can qualify for them.

Consider Customer Reviews

Read customer reviews and testimonials to gauge the overall satisfaction level with each insurer. Websites like J.D. Power, Consumer Reports, and the Better Business Bureau can provide insights into customer experiences, claims satisfaction, and complaint ratios for different insurers.

Evaluate Coverage Limits and Exclusions

Review the coverage limits and exclusions of each policy carefully. Ensure the policy provides adequate coverage for your needs and understand any limitations or exclusions that may apply. Pay attention to details such as coverage for rental cars, roadside assistance, and medical payments coverage.

Utilize Online Comparison Tools

Take advantage of online comparison tools to streamline the process. Websites and apps like Compare.com, Insurify, and NerdWallet allow you to enter your information once and receive multiple quotes from different insurers. This makes it easier to compare rates and coverage options side by side.

Review Annual Premiums and Payment Options

Compare annual premiums, as well as available payment options. Some insurers offer discounts for paying your premium in full annually, while others may allow you to pay in installments.

Consider the total cost of the policy, including any fees for installment payments, to determine the most cost-effective option for you.

Seek Advice from Insurance Professionals

If you’re unsure about certain aspects of insurance policies or need personalized advice, don’t hesitate to consult with insurance professionals or independent agents.

They can provide insights into policy details, coverage options, and help you navigate the quoting process to find the best insurance solution for your needs.

Frequently Asked Questions

What are the key factors to consider when selecting car insurance in Worcester, MA?

When selecting car insurance in Worcester, MA, key factors to consider include coverage levels based on driving habits and budget constraints, type of coverage required based on vehicle age and condition, driving habits, affordability of premiums, discounts offered, special features, customer reviews, deductible amounts, coverage limits, and policy exclusions.

How can individuals find the best car insurance coverage options in Worcester, MA?

To find the best car insurance coverage options in Worcester, MA, individuals are recommended to assess their insurance needs, compare quotes from multiple providers, evaluate provider offerings, check for discounts and benefits, review customer feedback, and consider factors like coverage levels, premiums, discounts, features, and policy terms before making an informed decision.

What is the average cost of car insurance in Worcester, MA?

On average, a minimum-coverage auto insurance policy in Worcester costs $70 per month or $839 per year. For a full-coverage policy, the average cost is $221 per month or $2,651 per year.

How can individuals ensure they are selecting the most suitable car insurance provider in Worcester, MA?

To ensure they are selecting the most suitable car insurance provider in Worcester, MA, individuals should assess their insurance needs carefully, compare quotes from different providers, evaluate coverage options, consider discounts, review customer feedback, and choose a provider that aligns with their coverage needs, budget, and expectations.

Conclusion

Choosing the right car insurance in Worcester, MA, requires careful consideration of coverage needs, insurer reputation, and affordability.

With average costs of $134 per month for full coverage and $92 for liability plans, drivers benefit from a competitive market featuring top providers like GEICO, Amica, and Progressive known for strong customer service and varied coverage options.

It’s essential to compare quotes, assess discounts, and review customer feedback to find the best fit. Prioritizing financial stability and efficient claims processing ensures both legal compliance and comprehensive protection on the road.

Making an informed decision guarantees peace of mind with reliable coverage tailored to individual circumstances and driving habits.

Natalie Kurtzman